If you are invested in a business’ success, I am talking to you.

You are a funder. You provide business loans, venture funds to accelerate growth. Or you’ve acquired an underperformer to invest in its recovery. You are a founder that wants to stay at the helm and grow for a few years before exiting.

Whether founder or funder, if you are invested in a business over a multi-year horizon, you want to maximize value creation over that time period. You want that business to grow and scale. You don’t want that business to limp along injured and exhausted– you want that business to thrive.

Why do businesses fail to scale and thrive?

People ask this question a lot. The implication is that if we can figure out the biggest reasons why businesses fail to thrive, we can solve those problems before they occur. Then more of the businesses we are invested in succeed and that’s what we want.

Yes. Let’s do that!

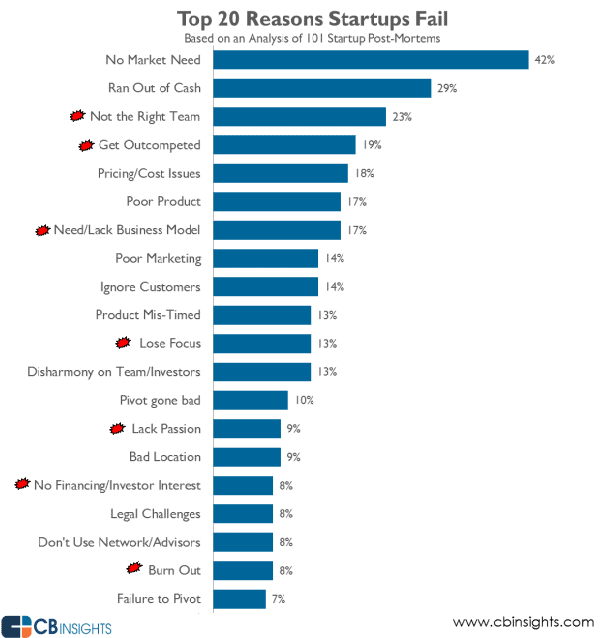

First let’s see what the interwebs have to say about this question. I found this survey with the top 20 reasons startups fail based on an analysis of 101 startup post-mortems.

source- https://www.cbinsights.com/blog/startup-failure-reasons-top/?

It’s as good a list as any. I marked those items that relate directly to leadership. There’s quite a few of them. Now look at the rest of the list. I challenge you to find a reason that doesn’t have right leadership as a root cause.

Leadership matters. A lot.

Getting leadership right turns into greater value creation. Which turns into bigger payoffs down the road. Which turns into greater wealth and job creation for society.

There’s a lot on the line! How can you increase your success in getting the leadership variable right?

A lot of people try to figure this out with intuition. Experienced founders who’ve had a lucrative exit become your experts. You read books by popular business writers. Fads and best practices are mis-used and over-used. This results in too many short term ‘feel good’ interventions with inconsistent and poor sustained results. On average.

You—the experienced founders and funders—are really good at what you do. You have a strong track record. You want great results. You have the wisdom and humility to keep learning every day, because that is the formula for getting better and better results.

While you’ve built empires and ecosystems, I’ve studied and practiced the business of how people optimize performance as individuals and organizations. I’ve consulted, been a practitioner inside organizations, and been mentored by deep experts. My experience has been with small to mid-sized businesses at many different stages of growth and decline.

Here’s what I’ve learned about leadership performance.

Getting leadership right comes in two parts.

1) Match capability & talent to strategy. Right leadership means matching capability and talents of your leaders to the demands of your business. The demands of the business are a function of the complexity of the strategy and business model. Match complexity of strategy to capability of top leaders. Match talents and desire to the operating model.

2) Sound Principles for Execution. Management is, in essence, orienting and coordinating the creativity of human beings. There are some really great execution frameworks out there like EOS and Rockefeller habits, and having good strategy-into-coordinated-action processes is a really important part of executing well. When a business has a well-built organization with capable leaders who know sound management principles, you will have high trust and optimal execution.

In this blog post, I’ll focus on the first part. Matching capability and talent to strategy.

Sound strategic talent mapping pays off.

If you can increase your success in getting leadership right, you increase the odds of building a thriving business with a bigger payoff down the road. You do this by mapping out the leadership needed to execute on the business’ strategy for the current and next stages of growth, whether that’s infancy, go-go, adolescence, or prime. And you—the executives and the investors—probably DO create this map.

How certain are you that your map is accurate?

As any funder or founder would admit in their moment of greatest humility, it is notoriously difficult to identify the right leadership team for any business, whether it’s a startup, growth business, or turnaround opportunity.

Some business leaders go from pure experience-informed gut instinct. Some rely on a proxy for capability based on a person’s experience with other businesses that have seen a similar growth curve as the growth curve you hope to recreate in the target business. Some create competency models of what ‘great leadership’ looks like riddled with confirmation bias and a deficit of business-specific context. Most often, founders and funders confidently employ an amalgam of these approaches.

All of these methods—these are Moneyball mistakes.

Just like the baseball recruiters in the book, it conflates common-practice-of-experts with real, actual success criteria. And that leaves an un-leveraged opportunity for those willing to use decades-old management-science-that-works in place of myth-based habits and the latest shiny-yet-unproven theory.

One of the most important criteria for success is the capability of a leader to handle ambiguity, complexity, and longer time horizons.

Research and case studies demonstrate how this capability is an actual, real success criterion for effective leaders for both the startup’s CEO and the investment firm’s partners.

If you are an experienced executive, you probably recognize that differences in this capability exist across different people and this difference can be make-or-break-it. What many executives do not realize is that there is an empirically proven, scientific method for measuring this type of capability and matching it to the demands of executing on a particular strategy.

This capability isn’t IQ. It isn’t EQ.

This difference is often described as tactical versus strategic, which is non-precise language. What one person considers strategic is another person’s tactical. This makes that distinction less useful for identifying right leadership.

Luckily, there is a more scientific, precise way to measure this capability.

Let’s talk about what happens when a business lacks this capability in their CEO and/or other key executive roles.

Business symptoms of inadequate leadership capability.

There are known problems that come from shortchanging your business’ leadership capability. This includes the capability of the CEO and/or other executives’ capability. I list a few symptoms below.

- A competitor moves faster and smarter and gains an upper hand in the market.

- Your sales grow slower than the growth you’re seeing in the category.

- There’s a tendency toward extreme approaches to process, with either a heroic avoidance of consistent process or unnecessarily overbuilt rigid process that doesn’t bend well with changing priorities.

- Strategy is espoused but not expressed through coordinated cross-functional action.

- Strategy implementation is hamstrung by one or two lagging functional areas or missing capabilities.

- Sales and profitability taper off and company feels stuck, unable to get to the next level.

- Complexity spirals, focus suffers, and performance saddens.

When one or more of these things happen, the team’s optimism turns into anxiety, which turns into frustrated panic. You might implement the latest popular execution system. Some people are removed from senior roles. And it seems to help. Things change, anyway.

But it feels a little more haphazard than you wish it did.

A compelling study with results that will surprise you.

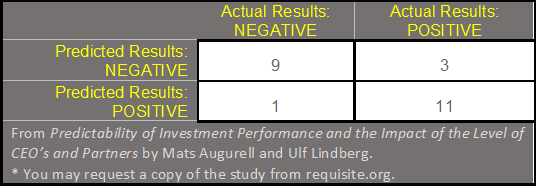

Consider a 2002-2010 study Mats Augurell and Ulf Lindberg conducted in Sweden that demonstrates a well-above-average ability to predict future business success out of a pool of 24 already-vetted businesses invested in by 6 private equity firms.

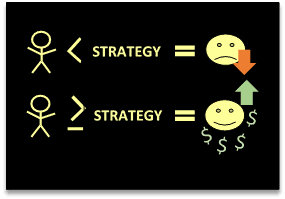

At the outset of the study, capability of CEOs of participating businesses were assessed and compared to the complexity of the business’ strategy. If the CEO’s capability was lower than the complexity of the strategy, the business was predicted to have negative results. If the CEO’s capability was equal to or higher than the complexity of the strategy, the business was predicted to have positive results.

Out of the 24 businesses, 12 were predicted to have positive results and 12 were predicted to have negative results. Granted, it’s a smallish sample, but check out these results. Correctly predicted outcomes for 20 out of 24 businesses.

This study provides solid evidence that matching the level of work capability for CEOs to the level of strategy is highly predictive of business success and the private equity firm’s ROI. Further, the study also discovered that having a baseline capability among the private equity firm partners at least one level higher than the CEO is also predictive.

How did they do it? What is this method of measuring and matching CEO and strategy complexity?

The best kept management science secret since the early 1960’s.

There is proven, established management science that works because it is consistent with how humans work and create together. It’s called Requisite Organization (RO) and its principles were unearthed by decades of in-business organizational research by a brilliant psychoanalyst named Elliott Jaques. The problem was that Jaques, while brilliant, didn’t suffer fools gladly.

This didn’t do a lot for the widespread adoption of RO.

Over the past 50+ years, a growing dedicated pool of change management and organizational consultants and academics have been researching and implementing Requisite Organization in businesses all over the globe. The evidence, when you know where to look for it, is compelling. The one study mentioned is just one. If you have an appetite for dense, scientific reading, you can find yourself neck deep in case studies, correlational research, and success anecdotes about RO.

Some make the mistake of assuming that because something isn’t splashy and widespread, it doesn’t work. People who think like that end up with mediocre results. Investors, however, know that this kind of information asymmetry is an untapped opportunity ripe with the promise of future economic rewards.

What management science tells us about right leadership.

[pullquote align=”normal” cite=”Mark Van Clieaf”]The most brilliant strategy can only succeed if the right people craft and implement it.[/pullquote]

Know this. You’ll no sooner achieve your strategy without requisite leader capability than you’ll make water boil without applying the requisite amount of heat.

Know this. You’ll no sooner achieve your strategy without requisite leader capability than you’ll make water boil without applying the requisite amount of heat.

You must have a leadership team capable of at least the same level of complexity as the complexity of your strategy, or the strategy will not be fully implemented.

Yes, there are other success criteria. And yes, it is the part that can be scientifically assessed.

Understanding what complexity of leader capability is.

As I mentioned earlier, complexity of leader capability refers to your leaders’ ability to manage ambiguity, look around corners, act today with the future in mind, and anticipate challenges. Experts use many different terms to describe this capability such as time horizon, complexity of information processing, comfort with ambiguity, strategic capability, stratum, and level of work capability. To name a few.

These terms indicate methods for measuring this capability. Measurement is done through several methods: time span of discretion interviewing, complexity of logic used to describe the nature of one’s work and decision dilemmas, and relative comparisons to known capability data. These techniques are highly convergent. And assessors, once trained, have very high inter-rater reliability.

We are familiar with the distinction between tactical and strategic.

While descriptive, these terms are neither precise nor commonly defined. What you should know is that there are 7-8 qualitatively distinct levels of problem-solving capability in adult humans and these levels line up precisely with the natural forms of human effort, or, as we commonly call it, work.

Setting a business strategy is an expression of human effort. It is a form of work. Thus, there are different levels of strategy. There are five of them. At any of the 5 levels of strategy, there exist collections of activities that are methods to achieve a strategy. We call these tactics. One business’ strategy is another business’ tactics. That’s why tactical and strategic are imprecise terms.

How to determine the complexity of a business strategy.

We talked about the 5 levels of strategy complexity. MVC International and many other researchers have outlined reproducible criteria and guidelines for identifying the complexity level of any business strategy. It is this decades-strong body of work that serve as the shoulders-of-giants that I stand on when I make these claims.

Next, I’ll describe some well-known examples and compare their complexity of business strategy to illustrate how this works. Then I’ll provide a chart that describes all 5 levels of strategy and each level’s minimum necessary CEO requisite capability. This should give you a sense for how this approach applies to the businesses you have or are considering investing in.

First example: Netflix’s early stage strategy and today’s strategy.

Netflix started off as a new service alternative to renting videos from Blockbuster and other video stores. This was a level 2 strategy requiring a work level 4 capable CEO to successfully implement. As technology evolved, Netflix up-shifted their strategy to play a part in changing the business model for how video content is curated, purchased, and consumed. This is a level 3 strategy requiring at least level 5 work capability in a CEO, which is where you’ll see Netflix listed on the strategy levels chart below.

Second example: Napster’s and iTunes’ strategies in an evolving market.

Napster was an easier way to “share” music. This is a process innovation and therefore a level 1 strategy. Being a compelling alternative to customers in terms of both price (free) and ease of use (high), the adoption was rapid. The challenge with process innovations is when the market is evolving quickly, it takes a more complex strategy to leapfrog ahead of the competition.

Which is what Apple did with iTunes, which represented a new business model (level 3 strategy) for how music is purchased and distributed. When all of Apple’s innovations are stacked together, they represent a more fundamental structural change to how humans use and interact with electronics. Apple today is functioning as a level 4 strategy—a structure innovator– as you’ll see below on the chart.

(reproduced with permission from Mark Van Clieaf, Organizational Capital Partners. You may download several written works by this author at mvcinternational.com.)

Applying the model to the local growth business ecosystem.

Most of the startups I see around where I live are level 1 and level 2 strategies that might have the opportunity to mature into a level 3 strategy with the right people at the helm. Level 4 and 5 strategies are beyond the scope of the startup and mid-sized growth business space. This means that you would want to invest in leaders capable of work levels 3- 5, contingent on the strategy complexity of the target business.

Getting right leadership starts to look a little tougher when you become aware of the supply constraints of capable leadership.

It’s worth mentioning that the percentage of the population aged 21-50 years old that are work level 3 is pretty small (4%), even smaller for work level 4 (.5%), and vanishingly small at work level 5 (.07%). That’s partly because this leadership capability develops over a lifespan. The numbers look a little more favorable if you consider leadership talent up to 70 years old. This evidence counters the myth that young founders deliver better results.

(source of numbers: The Life and Behavior of Living Organisms: A General Theory. By Elliott Jaques.)

Expand your selection pool by remembering that right leadership doesn’t always look just-like-us.

Non-precise, intuitively bundled criteria is more subject to the biases and filters we ALL have to subconsciously prefer people who look like, sound like, and think like us. Logically, we know that the like-me filter is noise that causes us to overlook right leadership talent. When we parse out REAL SUCCESS CRITERIA that can be consistently measured and validated across multiple raters and contexts, these biases have a much looser hold on us. This is an important thing to consider when you want to see more diversity in the leaders you invest in.

[pullquote align=”normal” cite=”Paul Graham”]What’s different about successful founders is that they can see different problems. [/pullquote]

What you really want to know about the team you’re investing in.

Let’s assume that you—the funders and founders– are working for the highest chance of optimal value creation over a multi-year horizon across all of your investments. As we saw in the research about the reasons that startups fail, right leadership is a critical part of getting the results you want. If you can supplement your experience-based instincts and expertise with empirically proven management science measurements, you are equipped to both make better investment decisions at the outset and better cultivate the organizations you’ve placed bets on.

What this kind of applied management science provides you:

- Level of strategy and capability of each leadership team member.

- Leadership capability gaps for future phases of growth will be identified.

- Talent profiles of the team that can be leveraged and where gaps will emerge.

- Greater objectivity about the peak capacity of the team as a whole and individual team members.

With this information, founders and funders have the information needed to ensure identification of right leadership. This information also helps you focus on the criteria that matter most so you can overcome common selection biases that unintentionally result in over-investing in founders-who-look-most-like-you.

These things are measurable. It’s not magic. It’s organizational engineering.

Imagine the difference that this knowledge makes in your success rate. I imagine it all the time. To me, it looks like something any smart founder and funder should do.

If you are invested in a business’ multi-year value creation, it makes good sense to apply sound management science that increases your odds and scale of success. When the business wins, you win, and the people win. Stack together several of these wins and the community wins.

Using science to win more.

(Shameless self-promotion alert!)

That’s why I’m piloting a Strategic Talent Mapping process designed to best meet the needs of momentum-hungry small to mid-sized growth businesses. If you’d like to participate as a beta customer, or just learn more, contact me at alicia@performentor.com or 919-730-9165.

But this isn’t all there is to right leadership.

Having requisite capability is only part of the formula. To ensure your team is optimally prepared to implement your business strategy, you must orient your leadership activities in a way that best leverage how human beings work. There are many common management practices that require humans to behave in non-human ways. That’s foolish.

In my next blog post, I talk about these principles and how to make sure you are getting the most out of your leadership development investments.